Which of the Following Produces Evaluations of Insurer Financial Status

Evaluation of financial status and general businessoperational plans. What company produces evaluations of insurer financial status often used by the insurance department.

How Regulatory Changes Are Driven By A Need For Control In Reputational Scandals A Case Study In The German Insurance Industry Emerald Insight

SUPPLIER EVALUATION QUESTIONNAIRE GP040 F1 Rev 10 Page 1 of 17.

. The following recommendations and interpretations are intended to interpret and amplify the application of the Guides and Interpretative Opinions as to Professional Conduct of the American Academy of Actuaries in relation to the financial reporting of insurance companies and are promulgated pursuant to. All of the following actions by a person could be described as risk avoidance EXCEPT. Part B requests details of your financial status.

Send a letter advising the client that if the information necessary for the financial evaluation process is not produced within 30 days the clients financial status will be changed to full. That you will receive immediately following the program. Participates in National Association of Insurance Commissioner NAIC working groups.

Financial status is an issue. Old agesurvivors and disability insurance social security B. In order to submit a claim for reimbursement from the Drunk or.

In order to submit a claim for reimbursement from the Drunk or Drugged Driving Prevention Fund a provider must verify that the offenders annual household income meets the following poverty guidelines issued by the US. The postmark on the envelope verifies the date when an insurer received a claim. A SEC b AM Best c NAIC d Consumers guide AM Best Company assigns ratings to life property and casualty insurance companies based upon the financial stability of the insurer.

Insurance companies licensed to operate in Mississippi must acknowledge receiving a claim within 15 days after receiving it. A daily financial report is a method to track the previous days activities that have an impact on your financial status but are not necessarily a strict financial metric. For additional information about continuing education call us at 1-800-926-7926.

Which of the following produces evaluations of insurers financial status often used by state departments of insurance. Evaluation of current assets insurance and taxestate strategies. It can keep you apprised of all the requisite data management used to track and measure potential errors internal production revenue loss and receivables status.

Which of the following insurance options would be considered a risk-sharing arrangement. The initial or annual financial evaluation or upon change in clients financialinsurance status. After receiving a claim a Mississippi car insurance company has to make an insurance claim decision within a reasonable time.

Storehouse Financial is not limited to any type of investment or fund family. Will review insurance eligibility information with the patient to ensure information accuracy. Which of the following produces evaluations of insurers financial status often used by state departments of insurance.

Which of the following is NOT true concerning the purpose of the Insurance Fraud. Discovery and data gathering of the current financial status. Most commonly known and widely used type of transactional insurance.

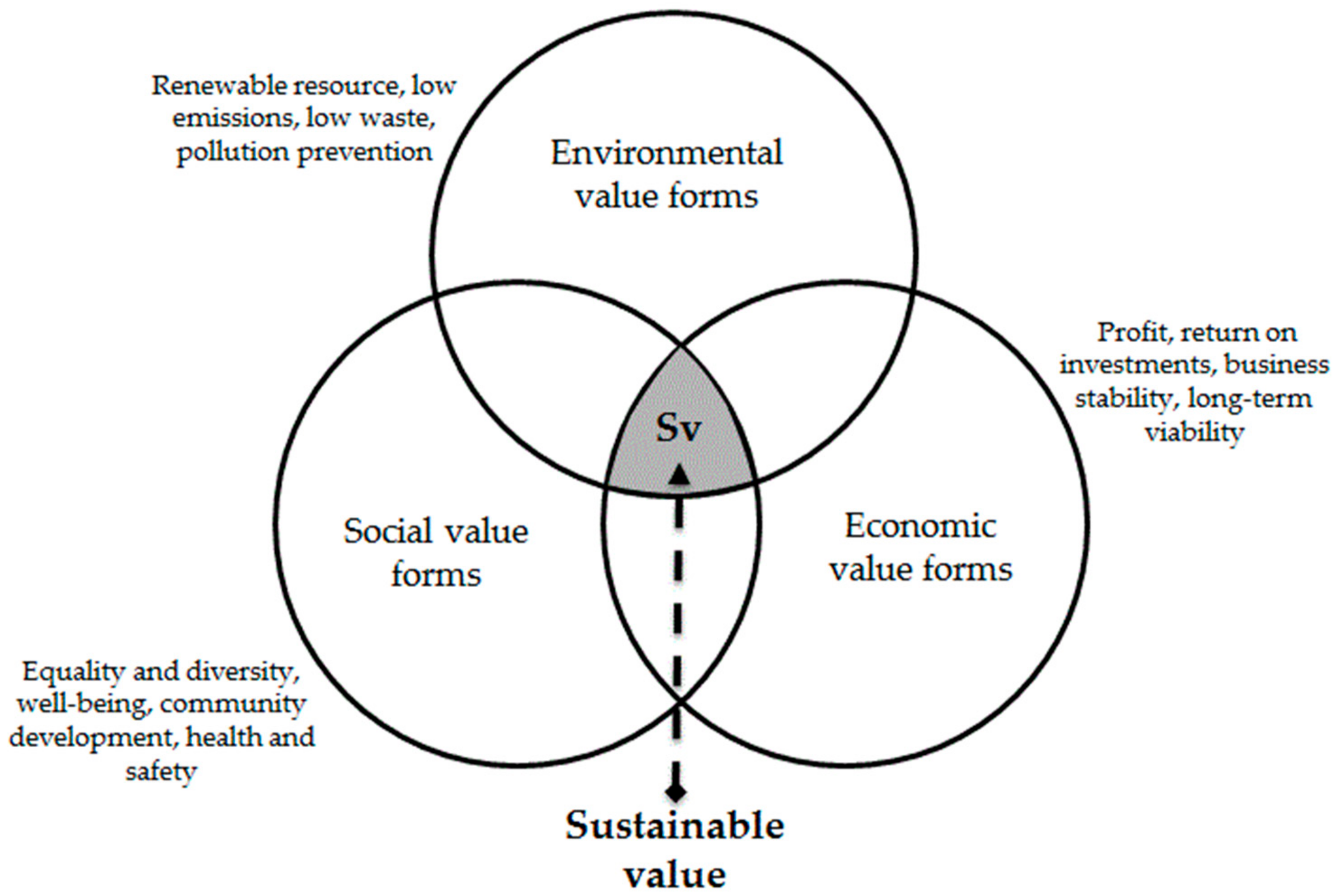

The agent has business cards and stationery printed. The insurer must be able to rely on the statements in the application and the insured must be able to rely on the insurer to pay valid claims. Approvesdisapproves the formation of insurance companies through the evaluation of financial status management risk management and general business plans.

This freedom to choose allows Storehouse to find the very best investments for your portfolio in the current market climate. The agent accepts a premium payment after the end of the grace period. Federal Insurance Corporation FDIC What company produces evaluations of insurer financial status often used by the insurance department.

If appropriate the patient is referred to a financial counselor andor offered information regarding the providers financial counseling services and assistance policies. The agent puts up a sign with the insurers logo without express permission. The purpose of this questionnaire is to allow RSL to identify a number of suitably qualified and experienced suppliers.

Which of the following produces evaluations of insurers financial status often used by state departments of insurance. DUI Risk Education shall be limited to one completed course per offender per DUI episode. The paper contains three sections.

An experienced financial advisor guides and directs you through the decision making process which involves the following steps. Proposed financial plan to meet goals. Part A seeks background information.

Department of Health and Human Services Washington. Which of the following produces evaluations of insurers financial status often used by state departments of insurance. Higher scores indicate better academic performance Tuition fee.

AM Best Company assigns ratings to life property and casualty insurance companies based upon the financial stability of the insurer. DUI Evaluations shall be limited to one evaluation per offender per DUI episode. Which of the following is an example of apparent authority of an agent appointed by an insurer.

Evaluation or course as described in part 2060. Federal Deposit Insurance Corporation FDIC D. Homogeneous The basis of insurance is sharing risk between a large homogeneous group with similar exposure to loss.

Covers financial losses resulting from any defects or deficiencies in the due. When initial financial evaluation occurs. To facilitate an informed use of insurers financial reports this manuscript reviews the accounting practices of insurance companies discusses the financial analysis and valuation of insurers summarizes relevant insights from academic research and provides related empirical evidence.

Academic performance is defined or regarded as participants examination grades at the end of a given duration term semester and programme. The questionnaire is split into 9 distinct parts. Which of the following is NOT a government insurance program.

Analysis and goal setting for financial situation. It could also be seen as the level of performance in a particular field of study. For billing purposes the unit of service shall be one completed evaluation or course as described in part 2060.

Because we do not accept commissions we can choose from hundreds of investment options and fund families. If an insurer meets the states financial requirements and is approved to transact business in the state it is considered to be.

Bancassurance And The Coexistence Of Multiple Insurance Distribution Channels Emerald Insight

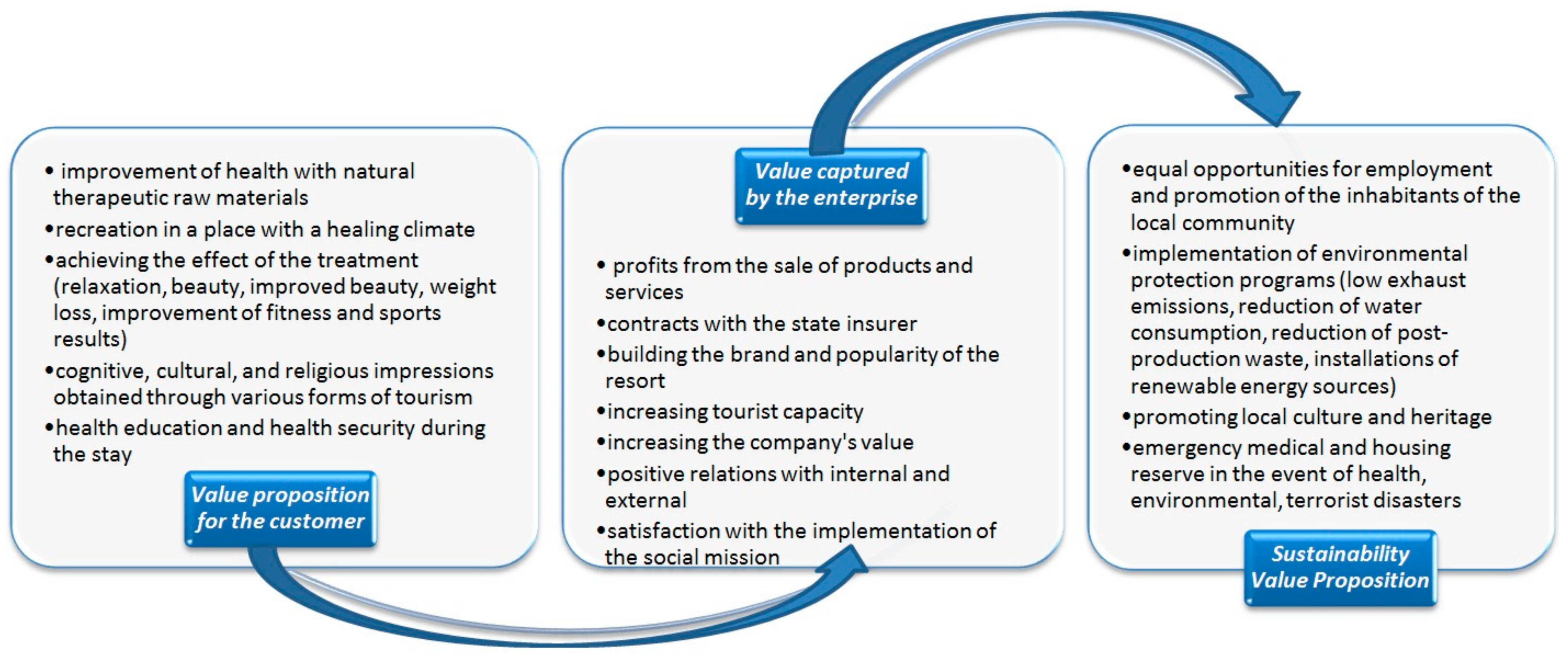

Joitmc Free Full Text Transformation Of Business Models In Spa Enterprises For Medical Purposes In Situations Of Epidemic Threats Html

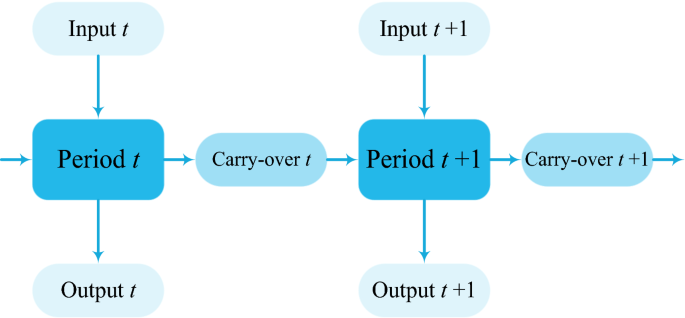

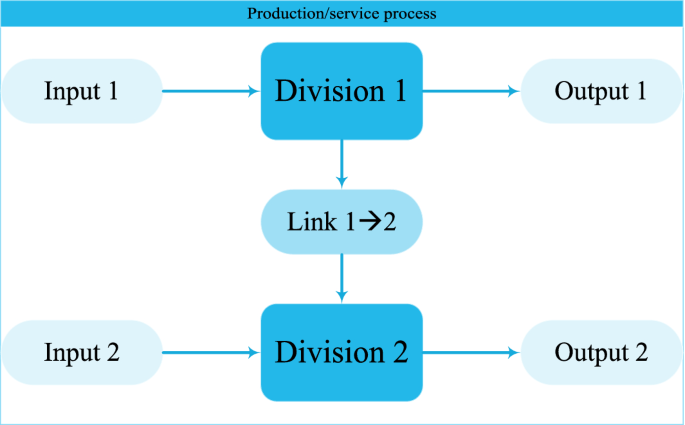

Evaluating Traditional Dynamic And Network Business Models An Efficiency Based Study Of Chinese Insurance Companies Springerlink

My Polaroid Pics From Vacation Polaroid Camera Pictures Polaroid Photography Instax Mini Camera

Insurers Risk Management As A Business Process A Prospective Competitive Advantage Or Not Emerald Insight

Insurers Risk Management As A Business Process A Prospective Competitive Advantage Or Not Emerald Insight

Bancassurance And The Coexistence Of Multiple Insurance Distribution Channels Emerald Insight

Blank Business Form Business Form Buisness

Earnings Persistence And Market Reaction To Earnings In The International Insurance Industry Visor Redalyc

Vsco Filters Vsco Filter Vsco Tutorial Vsco Photography

Evaluating Traditional Dynamic And Network Business Models An Efficiency Based Study Of Chinese Insurance Companies Springerlink

Chapter Iii Risk Transfer And The Insurance Industry In Risk Transfer And The Insurance Industry

Why Insurers Must Embrace Strategic Cost Transformation Ey Luxembourg

Inside An Insurance Company How They Work And What Drives Them Barnes Thornburg

Visor Redalyc Earnings Persistence And Market Reaction To Earnings In The International Insurance Industry

Why People Don T Buy Microinsurance

Joitmc Free Full Text Transformation Of Business Models In Spa Enterprises For Medical Purposes In Situations Of Epidemic Threats Html

Comments

Post a Comment